16+ Calculation Of Eva

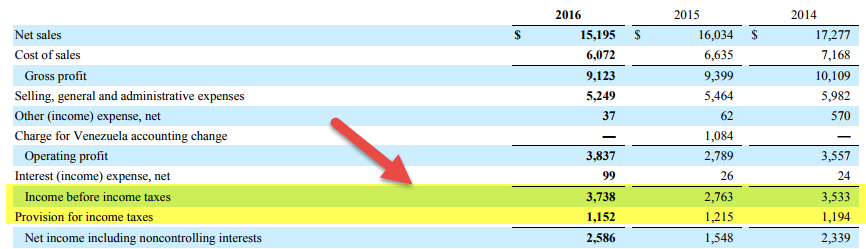

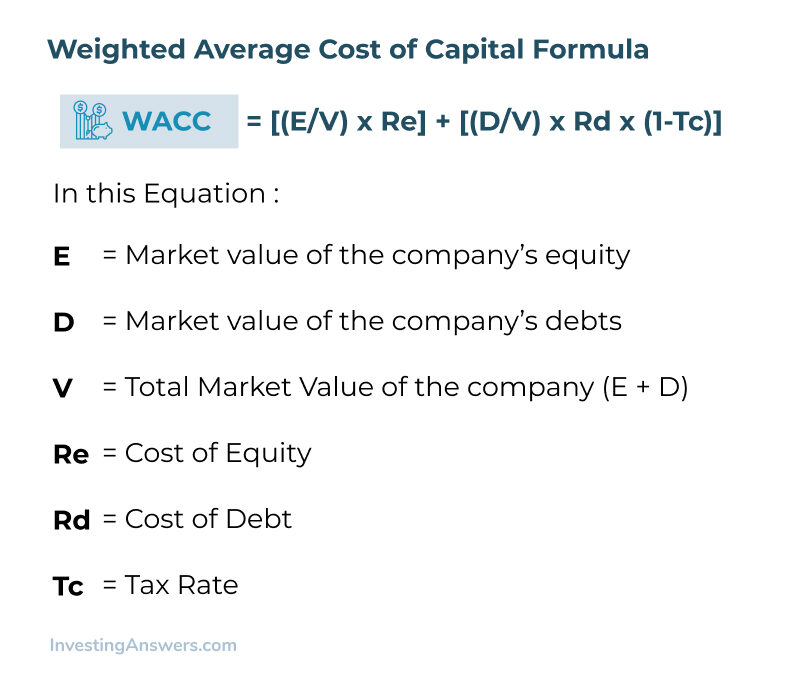

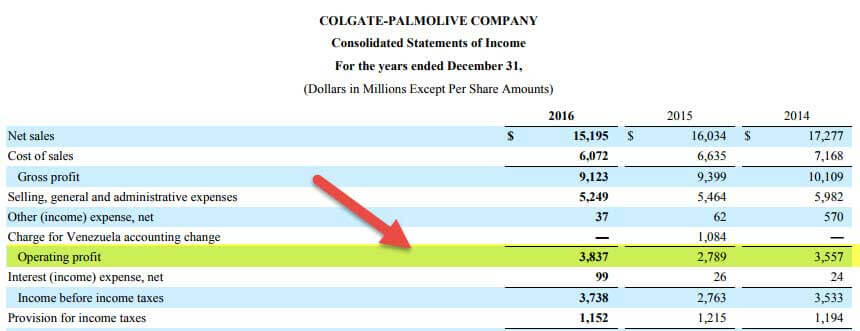

Web The weighted average cost of capital or simply called WACC is the most suitable measure for calculating the rate of return of a business as it includes all types of capital used by. Web Calculation of EVA Putting the economic value added formula into practice an EVA calculation could look like the following.

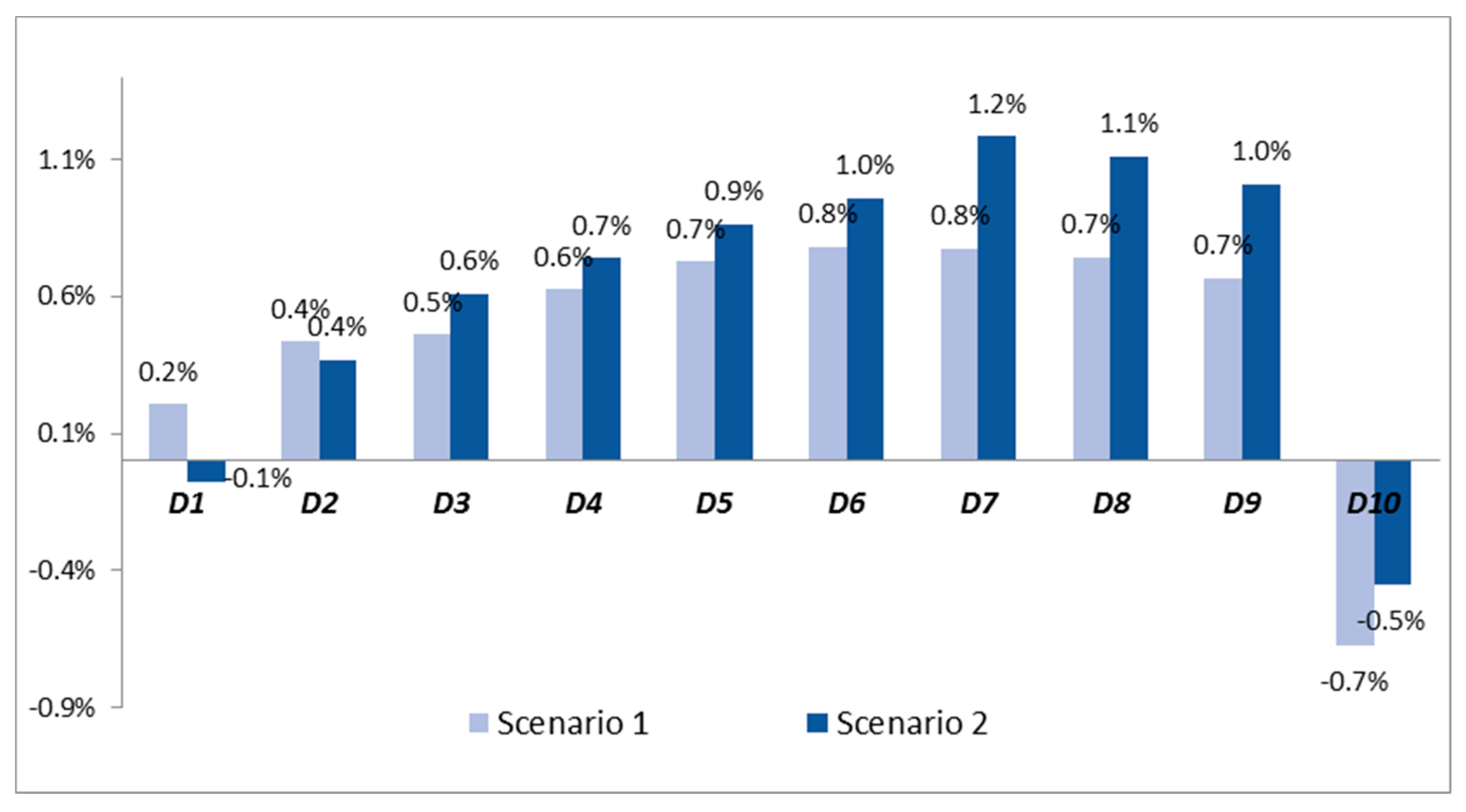

Sustainability Free Full Text Flat Rate Versus Progressive Taxation An Impact Evaluation Study For The Case Of Romania

According to Stern Stewart Co.

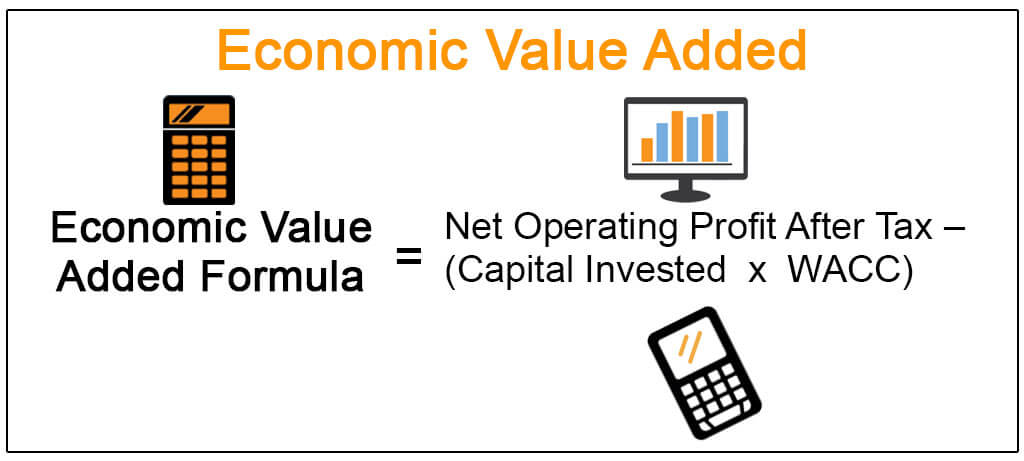

. Formula EVA is the outcome of deducting taxes and the weighted average cost of debt. Web EVA is calculated as follows. It is the excess profit above.

Web EVA adopts almost the same form as residual income and can be expressed as follows. Web The EVA formula is outlined below. Economic value of net assets.

However it distinguishes itself from traditional financial performance metrics such as net. Web Add back investment in new product to benefit future 10 - 2 8. EVA Net Operating Profit After Taxes NOPAT Capital Charges EVA EBIT 1 Tax Rate WACC Invested Capital Where.

Web The EVA Economic Value Added is an indicator of profitability and a measure of financial performance based on residual wealth. Web EVA can be calculated as net operating profit after tax minus a charge for the opportunity cost of the capital invested. EVA is based on the idea that a company must.

Web The EVA formula is. Marketing costs will be capitalized and amortized over several years. EVA NOPAT WACC capital invested Where.

A company has a net profit of 250000. EVA NOPAT WACC capital invested Where NOPAT Net Operating. Web Calculation of Economic Value-Added.

Web Calculating EVA The definition of EVA outlines three basic inputs we need for its computation - the return on capital earned on investments the cost of capital for those. Web EVA is a performance metric that calculates the creation of shareholder value. EVA Net Operating Profit After Tax Capital Invested x WACC Components of EVA Calculation Three components are necessary to solve for.

The capital charge is based on the weighted average cost of capital which. On the balance sheet average operating assets will increase by the. Web EVA adopts almost the same form as residual income and can be expressed as follows.

Economic Value Added Formula Example How To Calculate Eva

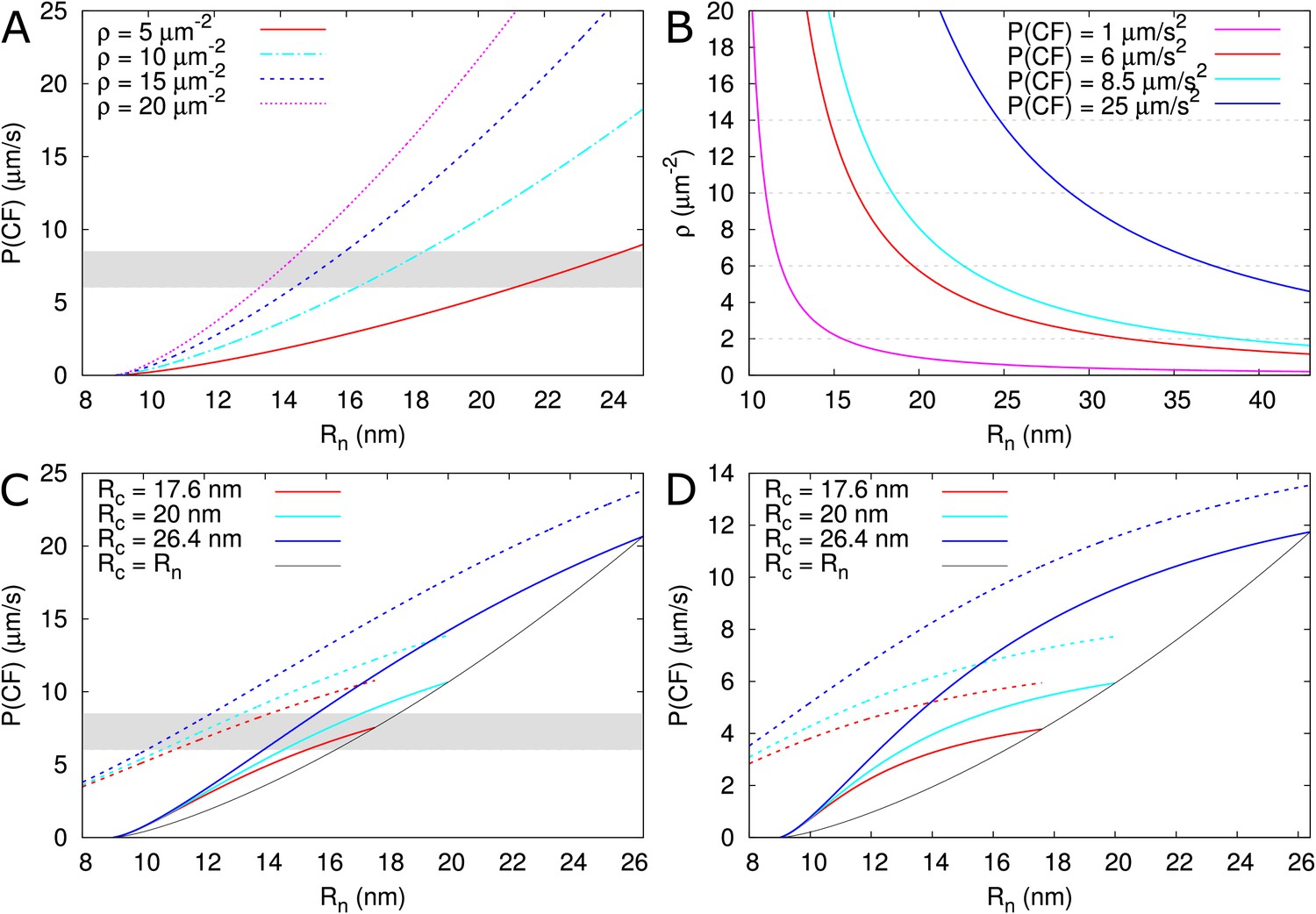

Computational Modeling Of Supramolecular Metallo Organic Cages Challenges And Opportunities Acs Catalysis

Economic Value Added Eva Break Down And Calculation Magnimetrics

The Energy Levels And Transitions Of Fe Xvi Fe And Fe Xvii Download Scientific Diagram

Automation World January 2021 By Pmmimediagroup Issuu

From Plasmodesma Geometry To Effective Symplasmic Permeability Through Biophysical Modelling Elife

Atn Mars 4 640 1 5 15x Smart Thermal Scope Atn Corp

Economic Value Added Eva Break Down And Calculation Magnimetrics

Economic Value Added Formula Example How To Calculate Eva

Economic Value Added Meaning Formula Investinganswers

Economic Value Added Eva Break Down And Calculation Magnimetrics

Economic Value Added Eva Break Down And Calculation Magnimetrics

Economic Value Added Formula Example How To Calculate Eva

Simultaneous Equations Mathematics Learning And Technology

Economic Value Added Eva Break Down And Calculation Magnimetrics

Immc Swd 282020 29500 20final Eng Xhtml 2 En Autre Document Travail Service Part1 V6 Docx

Economic Value Added Formula Example How To Calculate Eva